The situation where the seller sees his goods as more valuable than the buyer is normal and understandable. A company is a commodity in the market like any other, and there are several less and more complicated methods to find its value. However, how is it possible that the owner of the company and the potential buyer of the company get a different value of the company, even though both use the same valuation methods and the same source data?

Starting situation

When finding the value of the company, the main source of information is the annual reports of the last years with their appendices. The larger the company, the more appendices there are, and the better overview of the company's performance can be obtained. For simplicity's sake, we'll focus on the balance sheet and income statement for now. These reports provide a critical amount of information for valuation, on the basis of which the value of a particular business can be assessed.In addition to the reports, it is also necessary to choose the appropriate methods to find the value, after which all the prerequisites are in place to calculate the fair value of the company. Unfortunately, the obtained result often depends on who uses the evaluation models. The rule here is that the potential buyer of the company often gets a lower number than the owner of the company being sold, even though both are based on the same reports and formulas.

Let's take a closer look at how such a different result is obtained using the example of two valuation methods: the discounted cash flow method and the EBITDA multiplier.

Discounted cash flow method

The discounted cash flow method is one of the most widely used methods for valuing a company, as well as other investments. With this method, the value of a company is found based on how capable the company is of generating cash flows in the future.| Read more about the discounted cash flow method from our article "How to assess the value of a company?". |

Although the discounted cash flow method is based on a fairly precise formula, there is also some room for subjectivity, which is the interpretation of the various input data of the model. The main factor from which the different enterprise value in this method originates is the forecasting of future periods.

Let's take a closer look at the two main components of the future forecast, which are EBITDA for future periods and the discount rate.

EBITDA forecasting can be based on very different principles: based on the average of the last two or five years, be more pessimistic or optimistic about the future. The general recommendation is to remain rather conservative and not to use an extremely high or low EBITDA value unless its use is justified.

Projected EBITDA affects the value of the company to a considerable extent. Next, let's have a look at an example of how the value of this company can differ between an optimistic and a pessimistic approach. Let's start with the EBITDA of the last five years of the example company:

The average EBITDA of this company for the last five, three and two years is 130, 139 and 100 thousand euros, respectively. Using these averages in future forecasts, we get discounted cash flows (provided all other inputs remain the same) of 1105, 1184 and 842 thousand euros, respectively. Thus, the difference in the final result between using the average of the last two and three years, is more than 40%.

In order to be more confident about which EBITDA values to use in forecasting, you need to get more familiar with the company's performance. For example, if a stable near future is expected, the value could be calculated based on the average EBITDA of the last two years.

Naturally, it is not possible to predict the future by only looking at history. This is why InCorply incorporates a comprehensive approach in its valuation process, utilizing not only a company's annual reports but also leveraging additional input information to enhance the accuracy of the forecast. When assessing a company's value, the company's seller and the company's potential buyer also adjust the forecasts (in the direction they like), and thus the seller reaches a higher value than the potential investor.

When deciding on the discount rate, the situation is perhaps even more complicated, because the price of the capital used depends directly on the specific company (risk and profitability) and on which capital at which price is used for the purchase of the company.

The cost of Debt is usually cheaper, but it cannot always be used, and even if it is possible, its share is never 100%. At InCorply, we have encountered both sellers who believe there is no cost to capital and buyers who have it at a minimum of 33% per annum. Business is certainly a risky place to invest, but in the case of a company with a long history and stable profit, the discount rate could be between these two extremes.

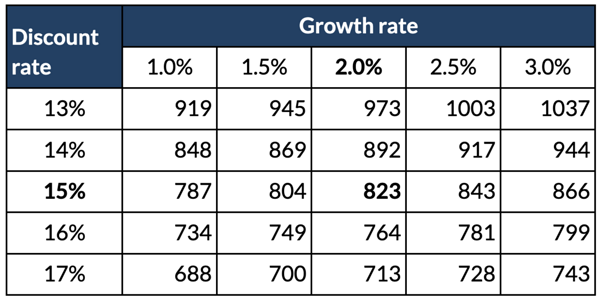

The discount rate plays an important role in finding the value of the company in the discounted cash flow method. This is illustrated by the sensitivity analysis below, where it is easy to see how much a different discount rate (and also the future growth rate) changes the value of an example company, ranging from 688 thousand to 1037 thousand euros.

EBITDA multiplier

The EBITDA multiplier is trivial compared to other methods, but it is arguably the easiest method to estimate the value of a company. This approach consists in multiplying the company's EBITDA by some number (on average 5), to which the difference between assets and liabilities is added. The obtained result is the value of the company.| Read more about the EBITDA multiplier method from our article "How to assess the value of a company?". |

When using the EBITDA multiplier method, the first question that arises is the same as with the discounted cash flow model: which average EBITDA value to use. The same principle applies here, that when forecasting, one should rather remain conservative and not go to extremes, and take into account the company's future prospects.

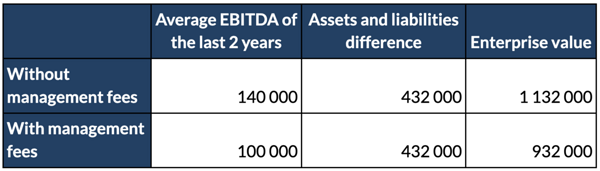

When using the EBITDA multiplier from the point of view of the company's seller and potential buyer, a significant difference often comes into play especially in the case of small companies. The reason is the fact that when a company changes ownership, the cost structure also changes immediately. Example of company value based on EBITDA multiplier:

In this example, the average EBITDA was used to find the value of the evaluated company, and the result was 1132 thousand euros. However, a closer examination of the profit and loss statement reveals that the owner of the company, who is also active in managing the day-to-day operations of the company, does not pay himself wages at market conditions. If the company changes ownership, the new owner must also hire a new manager and do so on market terms. As a result, the company's EBITDA also shrinks, which in turn affects the value of that company.

This is a simplified example, where the added management cost is arbitrary. There may also be something in the current cost structure that can perhaps be excluded instead. Nevertheless, the recommendation here is that you should always look into the numbers as precisely as possible and understand what is behind these numbers.

In conclusion

Using the same valuation model and source data, the seller of the company, its potential buyer and, as a third party, also the appraiser of the company's value, can all get a different value for the same company. This is mainly caused by the limited amount of information and knowledge and largely by interpreting the information in one's own favor. In many ways, this is inevitable, and it is not necessary to go into the reasons for it too much. However, it would be good if the parties could argue their results, were honest and oriented towards reaching an agreement.| Mati Maasik mati.maasik@incorply.ee |

If you require assistance in determining the value of your business, feel free to reach out using the form below.