.

What are my company's weaknesses and areas for improvement?

A prerequisite for a successful exit is, among other things, a company in good shape and with mitigated business risks. Many different metrics are used to evaluate the company's sales status, the number and content of which depend on the company's field, business model, and the buyer's focus. These are often issues that the company owner comes across only at the time of the sale of the company during due diligence (DD) on the part of the buyer.

A prerequisite for a successful exit is, among other things, a company in good shape and with mitigated business risks. Many different metrics are used to evaluate the company's sales status, the number and content of which depend on the company's field, business model, and the buyer's focus. These are often issues that the company owner comes across only at the time of the sale of the company during due diligence (DD) on the part of the buyer.

The more mistakes and business risks are found in the company being bought during due diligence, the more likely it will negatively affect the sale price of the company.

It is possible to avoid such a situation if, before selling the company, you pay attention to the circumstances that need to be fixed and corrected. During the service, we review important topics that shape the attractiveness and sale price when selling a company, including: financial indicators, salaries, ratios and accounting, customers, sales and marketing, production management, inventory, product portfolio, team, company management.

It is possible to avoid such a situation if, before selling the company, you pay attention to the circumstances that need to be fixed and corrected. During the service, we review important topics that shape the attractiveness and sale price when selling a company, including: financial indicators, salaries, ratios and accounting, customers, sales and marketing, production management, inventory, product portfolio, team, company management.

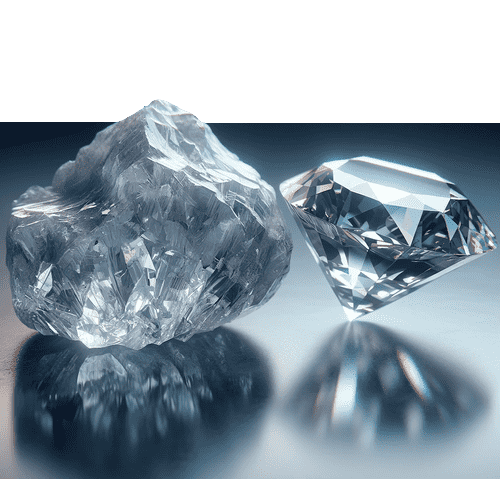

| Identifying deficiencies and/or areas for improvement and solving them significantly increases the company's attractiveness in the eyes of a potential buyer and increases the compensation received for the company. | |

| The service is also useful for entrepreneurs who for some reason do not want (or no longer want) to sell their company - the benefits in the form of better results and mitigated risks are guaranteed. |

How to increase company value?

If you would like to consult on how to increase the value of your business, don't hesitate to contact us.